Philippines: Otto Energy buys Vitol's stake in Galoc oil field and assumes operatorship.

Philippines: Otto Energy buys Vitol's stake in Galoc oil field and assumes operatorship

12 Aug 2011

- Galoc acquisition delivers greater share of revenue, providing additional funds for investment into future growth

- Assumes 100% ownership of Operating Company of producing Galoc field; important growth step for Otto

- Purchase price equivalent to US$19.00 per barrel (2P reserves) and US$11.50 per barrel (2P reserves + 2C resources); attractive at current oil prices

- Galoc joint venture focused on sanction of Phase 2 in early 2012

- Increase Otto’s proven and probable reserves by 0.98 million oil barrels

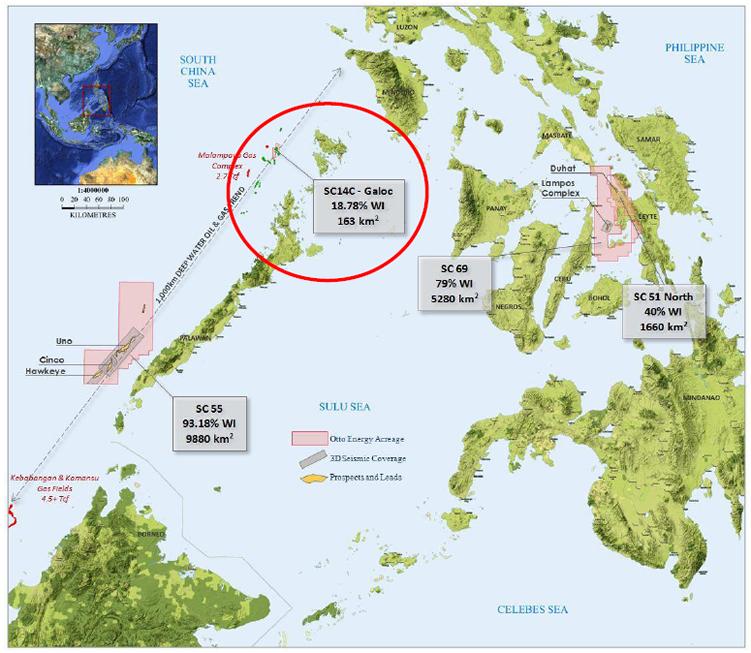

- Complements Otto’s suite of high potential exploration projects in the Philippines

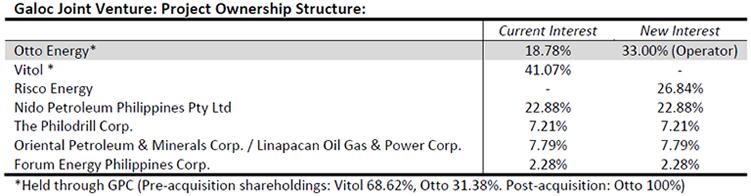

Otto Energy has entered into various definitive agreements to increase its stake in the producing Galoc Oil Field offshore the Philippines from an indirect 18.78% to direct 33.0% under Service Contract 14C. Otto will assume 100% ownership of the Operating Company of the field, which is currently producing 6,800 oil barrels per day, on a 100% basis.

Under the terms of the transaction, Otto has agreed to acquire a 68.62% interest in the Galoc Production Company (GPC), the operator of Galoc, from Vitol Group, increasing Otto’s interest in GPC from 31.38% to 100%. Through the acquisition Otto will initially increase its stake to 59.84% of Service Contract 14C. Otto has then agreed to cause GPC to on-sell, on the same per percentage point terms, a 26.84% of this stake to Singapore energy investment company Risco Energy, bringing Otto’s post acquisition stake in Galoc to 33.0%. This transaction is subject to relevant Philippines government approvals.

The effective date of the purchase agreement is 1 April 2011. The total purchase price for Otto’s share of the purchase price is US$18.7 million. The acquisition will be funded from Otto’s existing cash reserves. Completion is scheduled to occur prior to 30 September 2011.

Under the terms of the transaction, Otto has agreed to acquire a 68.62% interest in the Galoc Production Company (GPC), the operator of Galoc, from Vitol Group, increasing Otto’s interest in GPC from 31.38% to 100%. Through the acquisition Otto will initially increase its stake to 59.84% of Service Contract 14C. Otto has then agreed to cause GPC to on-sell, on the same per percentage point terms, a 26.84% of this stake to Singapore energy investment company Risco Energy, bringing Otto’s post acquisition stake in Galoc to 33.0%. This transaction is subject to relevant Philippines government approvals.

The effective date of the purchase agreement is 1 April 2011. The total purchase price for Otto’s share of the purchase price is US$18.7 million. The acquisition will be funded from Otto’s existing cash reserves. Completion is scheduled to occur prior to 30 September 2011.

Attractively Priced, Low-Risk Opportunity

The acquisition will increase Otto’s proved and probable (2P) reserves by 0.98 million barrels, with an additional 0.64 million barrels of contingent resources (2C). Recently the SC14C joint venture approved the upgrade to the mooring and riser system for the Galoc FPSO. This is expected to substantially increase the operating uptime of the field, and is crucial infrastructure to facilitate a Phase 2 development.

The purchase price for the acquisition is equivalent to US$19 per barrel for proved and probable reserves and US$11.50 per barrel with the inclusion of contingent resources, which relate to Phase 2. The field currently enjoys a net back of around US$50 per barrel after all costs, taxes and other charges.

Through 100% ownership of GPC, Otto becomes the Operator of the field, a crucial step in the development from an exploration to an integrated oil and gas company. The acquisition will also realise cost synergies as Otto consolidates the operating office of GPC in Manila with its current Perth and Manila offices.

Otto Acting Chief Executive Officer Matthew Allen said:

'This acquisition represents an attractively priced, low-risk opportunity for Otto to increase its share of revenue from Galoc, as well as to better leverage the expertise within the group through assuming Operatorship. Galoc is a proven producing asset that we know well and that complements our high potential Philippines exploration portfolio. The revenue from Galoc continues to provide a valuable source of funds for reinvestment and this is set to grow as we move towards a Phase 2 expansion of the project. We look forward to working with our joint venture partners and the Philippine Department of Energy to advance the successful Galoc project under Otto’s Operatorship.'

Strong Current Production Performance

Recent performance at Galoc has been encouraging with current production at approx. 6,800 barrels per day. The field has delivered 23 offtakes to refinery customers to date with one additional cargo scheduled for delivery prior to the FPSO being taken out of the field in September.

Galoc has had an average operating uptime of 100% over the past four months, and now has a year-to-date 12-month rolling average uptime of 88%. The upgrade to the mooring and riser system is planned for the fourth quarter of 2011, and following installation is expected to improve FPSO operating uptime to in excess of 95%. The cost to Otto of the mooring and riser upgrade is modest at US$3.6 million based on a 33.0% interest in SC14C.

It is anticipated that final investment approval for a Phase 2 development of Galoc will be targeted for early 2012, subject to satisfactory results from a planned 3D seismic acquisition.

The acquisition will increase Otto’s proved and probable (2P) reserves by 0.98 million barrels, with an additional 0.64 million barrels of contingent resources (2C). Recently the SC14C joint venture approved the upgrade to the mooring and riser system for the Galoc FPSO. This is expected to substantially increase the operating uptime of the field, and is crucial infrastructure to facilitate a Phase 2 development.

The purchase price for the acquisition is equivalent to US$19 per barrel for proved and probable reserves and US$11.50 per barrel with the inclusion of contingent resources, which relate to Phase 2. The field currently enjoys a net back of around US$50 per barrel after all costs, taxes and other charges.

Through 100% ownership of GPC, Otto becomes the Operator of the field, a crucial step in the development from an exploration to an integrated oil and gas company. The acquisition will also realise cost synergies as Otto consolidates the operating office of GPC in Manila with its current Perth and Manila offices.

Otto Acting Chief Executive Officer Matthew Allen said:

'This acquisition represents an attractively priced, low-risk opportunity for Otto to increase its share of revenue from Galoc, as well as to better leverage the expertise within the group through assuming Operatorship. Galoc is a proven producing asset that we know well and that complements our high potential Philippines exploration portfolio. The revenue from Galoc continues to provide a valuable source of funds for reinvestment and this is set to grow as we move towards a Phase 2 expansion of the project. We look forward to working with our joint venture partners and the Philippine Department of Energy to advance the successful Galoc project under Otto’s Operatorship.'

Strong Current Production Performance

Recent performance at Galoc has been encouraging with current production at approx. 6,800 barrels per day. The field has delivered 23 offtakes to refinery customers to date with one additional cargo scheduled for delivery prior to the FPSO being taken out of the field in September.

Galoc has had an average operating uptime of 100% over the past four months, and now has a year-to-date 12-month rolling average uptime of 88%. The upgrade to the mooring and riser system is planned for the fourth quarter of 2011, and following installation is expected to improve FPSO operating uptime to in excess of 95%. The cost to Otto of the mooring and riser upgrade is modest at US$3.6 million based on a 33.0% interest in SC14C.

It is anticipated that final investment approval for a Phase 2 development of Galoc will be targeted for early 2012, subject to satisfactory results from a planned 3D seismic acquisition.

Source: Otto Energy

Comments

Post a Comment